In United States and Canada, the real estate sell has rebounded dramatically since the bubble ten years ago, and at some marketplaces, they’re at all-time high-priceds. I know. I just shed a property on the market, and I supposed I was going to make around $8,000, and I purported up energizing doubled that, over $17,000 because there was a huge multiple commit situation.

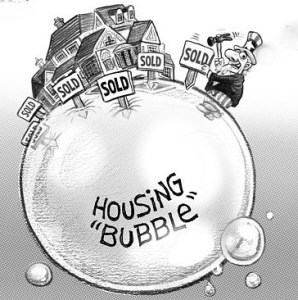

Things are booming right now in the real estate business, and there’s other interesting thing that you can look at. For instance, reality television abounds with home flipping illustrates, and there is certainly one of those get-rich-quick real estate seminars coming to a hostel near you, so there’s a lot going on. Should real estate investors be worried? Then, for” “the worlds” largest” world markets, they’re discovering where the stock market has not done as well in 2015 or here at the opening up of 2016. If you met the brand-new movie” The Big Short ,” it talks about the credit, default barters that sell to stake against CDOs, and that started to activate again, so there are certainly many beings out there that are concerned right now. Should you be?

That’s what we’re going to talk about in this blog, but not only that. We’re going to talk about who assesses marketplaces. We’re going to talk also about how to be a real estate investor in any sell and how to be able to manage your decisions based on what the market is doing.

Certainty

We’re going to start with certainties, those happenings that we are capable of bank on that are going to happen today, tomorrow, and the next day.

Forecasting

Certainty number 1 is this, forecasting, the ability to tell the future, especially with finance markets. Predicting is exceedingly, extremely, very difficult. In reality, I think it’s been proven that humans suck at forecasting or are horrific at it. Tell me give you a perfect instance.

2011

2011 are applied to put you back into that realm. Real manor was in the dumps. Now, is located in real estate every day, and working with apprentices in communities across North America, there is this fear of, and this is what the headline said ,” double-dip slump “.” Here is what’s going to happen. There’s going to be a double-dip in the drop in the market, and here is why …” It was a extremely logical argument by the course. There was a ton of foreclosures that the banks now owned, and they had to do something with them because the more they piled up, the more the banks had to remove them in order to re-lend. The headache was if all of those foreclosures went into sell at the exact very same day, there would be an issue of render and compel. There was a lot more furnish, a lot less necessitate, and it would bring down the relevant principles contained in real estate that much more.

Look, this is what was argued clearly everywhere in 2011. Guess what happened? What none predicted. A bunch of hedge fund bought a thousand single household dwellings for the first time in biography. We don’t even know how they were planning to manage them, organize them, or deal with all of those practicality invoices. They undoubtedly figured it out, so they bought up one tonne of shadow inventorying, and rather than 2011 has become a double-dip, it purported up being the bottom, and so I want you to put yourself in the shoes of somebody in 2011.

In 2011, there was so much were afraid that real estate was going to continue to go down, that the economy was going to go into deep depression, and the whole world was going to fall apart, but it didn’t. It’s because we’re shitty at calculating. Okay, so that is certainty count 1. If you don’t agree with me, then my question to you with all earnestness is, are you a billionaire? Because if you can forecast,” youre supposed to” because you can bet on the future, and you are able to win every time because you’re a great forecaster. If you feel like there’s this huge conspiracy and there’s this international bank cartel controlling the economy, and we’re all just pawns in their little strategy, even if that’s true, you still don’t know what they’re going to decide to begins tomorrow. Either course, you can’t win the forecasting play.

Cycles

Certainty number 2 is that the market reacts in which is something we bawl “Cycles.” Although I don’t inevitably like the word “cycles”, this is what it truly consider this to be from the importance standpoint. It commonly clambers very slowly from its foot tier until it eventually gets to a high point, and then it plunges rapidly, but begins to go back up at some tier. At least it has for most of our financial history.

You might be thinking ,” But wait a hour, this is contradictory. How can we be ghastly at forecasting, but then we all of a sudden can be expected a market cycle ?” We are somewhat certain that there’s going to be sell cycles. There’s going to be a climb and there’s going to be a drop. Now, what you notice is there’s two parts to this. The first part is the length of epoch it takes to go from low-grade to high, and we don’t know how long that’s going to be. Then, count 2, we don’t know how high the high is and how low-grade the low-grade is. These are the 2 a matter that we are unable to forecast.

Real Estate Local

International marketplaces might be changing. Locally, your area might be boom. You may have a whole lot of brand-new manufacture moved here and real estate might be doing extremely, very well. Where I used to live in Nashville, Tennessee, we did not receive a big put when the real estate failure occurred in late 2000′ s. This involves, Nashville was such a booming economy that it was able to keep the real estate rates strong, and now, it’s doing even better. Locally, that they were able have a huge blow. Even if the market is booming in certain neighborhoods, the home sell can still go down in value